A deep dive into the B.C. government budget that was tabled last week reveals that the fiscal plan may not bleed as much red ink as most headlines suggest.

While it is true the budget’s bottom line is a projected deficit of $4.2 billion in the coming fiscal year (which starts April 1) and slightly lower deficits in each of the following two years, the fiscal plan once again includes billions of dollars of unallocated spending.

Most of this money is included in vaguely defined contingency funds. The total for the coming year is $5.5 billion, followed by $4.8 billion next year and $4.7 billion the year after that.

While it is true much of this money will end up being spent over the course of the fiscal year (to pay for public sector wage increases, climate emergencies and the ongoing pandemic recovery) it is quite conceivable that a lot will not be spent, thus potentially greatly decreasing the size of the budget deficit (or even eliminating it).

Then there is the “forecast allowance” that is built into each annual budget (it serves as a financial cushion in case revenues fall seriously short of what was expected). That number is $700 million in the coming year, and $500 million in each of the following two years.

It all adds up to almost $17 billion, which is much more than the combined deficits of $11 billion over three years.

Moreover, the Finance Ministry once again may have applied its usual (and prudent) practice of lowballing some revenue estimates.

For example, it is projecting a $1.7 billion drop in personal income tax revenue from the current year. This follows a huge increase in the current year of almost $5 billion over what was projected last February.

While the big unanticipated jump was due in a large degree to restated tax assessments by the federal government, other factors such as high employment levels and an increase in high-income earners played a role as well.

Given that employment levels are expected to remain strong, there is every chance that personal income taxes could increase and not decline (or not decline as much as projected) in the coming year.

Finally, the ministry is projecting a minuscule economic growth rate of just 0.2 per cent. While no one is predicting growth rates much higher than that, once again the prudent ministry has opted to take the more pessimistic view.

Put all this together and it explains why at least two of the critically important bond rating agencies will likely keep their high credit rating for the B.C. government intact.

Last week, Moody’s Investors Service released a commentary on the budget and said it was “well-protected” against any economic headwinds, largely because of the huge contingencies and the other factors I have pointed to.

Likewise, DBRS Morningstar weighed in the next day with its analysis, noting the budget “includes several layers of prudence.”

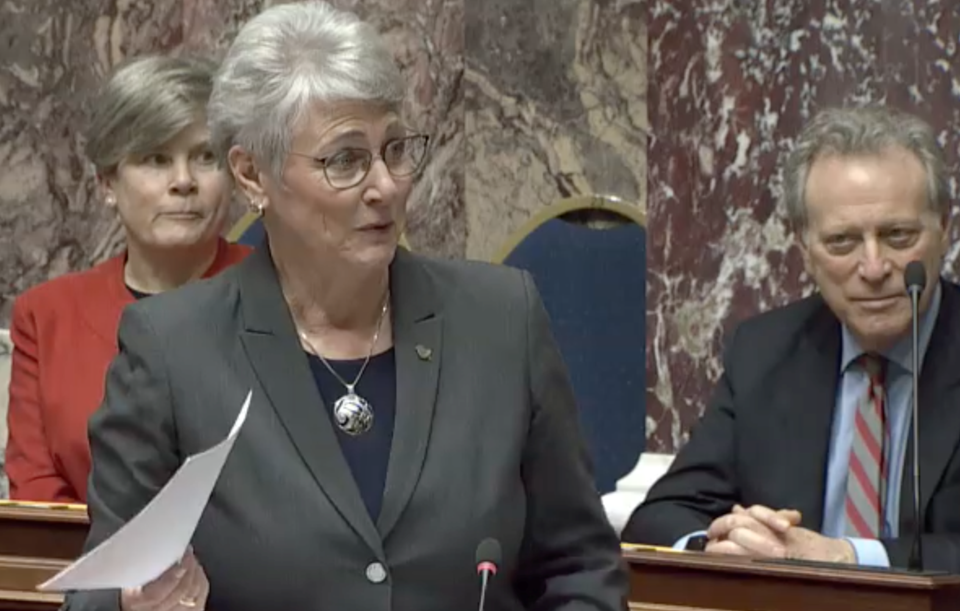

Both agencies essentially said they liked what they saw in Finance Minister Katrine Conroy’s first budget.

Keeping the credit rating high (something the BC NDP didn’t seem to care about while in Opposition) is important for a government because it keeps borrowing costs lower (the government has inherited that high credit rating from the previous BC Liberal government).

We should know by November (the timing of the second quarterly report) whether this budget will indeed bleed a lot of red ink, or whether there’s even a chance it could end up being in the black.

It has happened before.

Keith Baldrey is chief political reporter for Global BC.